Taxation

Understand your responsibilities

Income Tax and National Insurance

Income tax and National Insurance Rates

The current rates and limits for Income Tax and National Insurance can be downloaded by clicking on link below.

https://www.gov.uk/income-tax-rates

What is Income Tax?

There are currently eight taxes that are levied in the UK by central government. These are divided into two major categories, Direct and Indirect.

- Direct Taxes

- Income Tax

- National Insurance

- Corporation Tax

- Capital Gains Tax

- Inheritance Tax

- Stamp Duty

- Indirect Taxes

- Value Added Tax (VAT)

- Customs Duties (including duties on alcohol, petrol and tobacco

Between them, Income Tax and National Insurance amount to approximately 50% of the total tax collection.

Income tax is paid by Individuals (whether self-employed or employed), partners in a partnership, trusts and personal representatives, provided they are resident and domiciled for tax purposes (If you are not resident and/or domiciled there are rules that need to be understood, it is best to consult a qualified person). Most types of income are taxed under schedules. Each schedule has a set of rules used to determine the amount of income that is taxable

- Schedule A – Income from land and buildings

- Schedule D Case I and II – Profits from trades or professions

- Schedule D Case III – Interest Received

- Schedule D Case IV – Interest on foreign securities

- Schedule D Case V – Income from foreign possessions

- Schedule D Case VI – A catch all e.g. ad-hoc commissions

- Schedule E – Income from Office or Employment (Usually known as PAYE)

- Schedule F – Dividends received from UK Companies

Making sure you compute the correct amount of taxable income under each schedule can be a complex area and it is always prudent to seek qualified advice. All resident individuals, regardless of age, are entitled to the Personal Allowance. The effect of personal allowance is that the first part of income in any year up to the amount of the allowance is free of tax.

Income Tax Self-Assessment Return

Most persons who are self-employed or are partners in a partnership will be expected to prepare a self-assessment tax return (Note that partnerships also have to additionally file a partnership statement) and pay the tax in two tranches, one in July and the other in January. This is different to an employed individual who will have tax deducted each time they receive their salary or wages.

The usual timings for the self-assessment events are as follows. Revenue and Customs will send out forms just after the April tax year-end. Taxpayers will need to compute their tax liability and return their self-assessments by the 31st January following. Any outstanding tax liability is also payable by the 31st January. Also on 31st January a payment on account representing half the previous years tax liability is due and another on 31st July.

There are penalties for the late deliveries of tax returns as well as penalties and interest on late payments of tax.

National Insurance Contributions

National Insurance contributions are paid both by self-employed and employed persons. Additionally a person who is neither employed nor self-employed may make voluntary contributions in order to qualify for social security benefits

Rates of National Insurance contributions are given in the downloadable tables above.

There are currently four classes of national insurance contributions:

- Class 1 – for employed individuals

- Class 2 – for self-employed individuals

- Class 3 – voluntary contributions for individuals not employed or self-employed

- Class 4 – for self-employed individuals according to the level of their profits

Class 1

Provided an individual earns above a limit (known as the Earnings Threshold) then class 1 contributions are payable both by the employee (Class 1B) and the employer (Class 1A). The contributions are calculated as a percentage of the taxable earnings of the individual. There is an upper earnings limit above which the employee contributes at a lower rate. Certain benefits in kind (Company cars, purchased health care etc) can also attract class 1A contributions.

Class 2

Liability to class 2 national insurance is for a self-employed person. Class 2 has to be paid weekly usually by standing order as a fixed amount. A newly self-employed person must inform the HM Revenue & Customs within 3 months of becoming self-employed. It is possible to apply for a small earnings exception and not pay class 2 if annual earnings are below the level. Generally this may not be advantageous as benefits entitlement is affected.

Class 3

Class 3 contributions are paid voluntary by persons who are neither employed nor self-employed. There payment provides and entitlement to a state pension. The payment is made weekly as a fixed amount usually by standing order.

Class 4

Self-employed persons pay class 4 contributions based upon the level of their taxable profits. Class 4 is paid in addition to class 2. The contribution is calculated as a percentage of the taxable earnings. A smaller contribution rate is applied on earnings above an upper earnings limit.

Corporation Tax

What is Corporation Tax?

There are currently eight taxes that are levied in the UK by central government. These are divided into two major categories, Direct and Indirect.

- Direct Taxes

- Income Tax

- National Insurance

- Corporation Tax

- Capital Gains Tax

- Inheritance Tax

- Stamp Duty

- Indirect Taxes

- Value Added Tax (VAT)

- Customs Duties (including duties on alcohol, petrol and tobacco

Corporation Tax amounts to approximately 12% of the total tax collection.

Corporation tax is paid by companies resident in the UK for tax purposes. A company can mean a corporate body but also an incorporated association (other than a partnership or a local authority or a local authority association) such as a sports club or political association. Additionally the UK branches or agencies of a non-resident company are also subject to Corporation Tax.

A company is resident in the UK if that is where it is incorporated; a company that is incorporated out side of the UK can be considered resident if its central management and control is exercised in the UK.

Corporation Tax is assessed under schedules. Each schedule has a set of rules used to determine the amount of income that is taxable.

- Schedule A – Income from land and buildings

- Schedule D Case I – Trading profits (or losses) usually from accounts

- Schedule D Case III – Interest on non-trading loans

- Schedule D Case V – Income from foreign possessions

- Schedule D Case VI – Non-trading gains on intangible fixed assets

- Chargeable Gains – Capital gains

Special rules apply when a company has a “loan relationship”, which basically means the company either owes or is owed amounts provided as a loan. This can cover bank deposit accounts (notionally the company has lent money to the bank), loans from banks or other creditors as well as bonds. If the loan relates to trading then any interest payable or receivable is dealt with as schedule D Case I, however if it is non-trading then the interest is dealt with as schedule D Case III. Note that bank deposit interest receivable is always treated as non-trading.

Similar special rules also exist for dealing with intangible fixed assets, some times known as “Intellectual Property”.

Making sure you compute the correct amount of taxable income under each schedule can be a complex area and it is always prudent to seek qualified advice.

Basis of Assessment

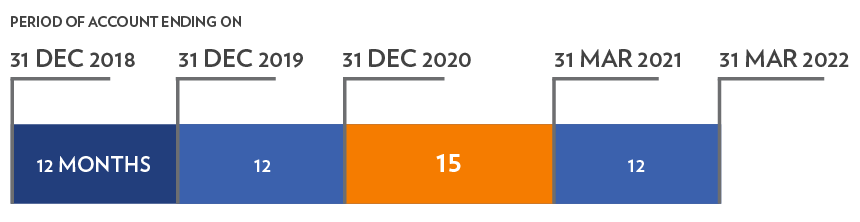

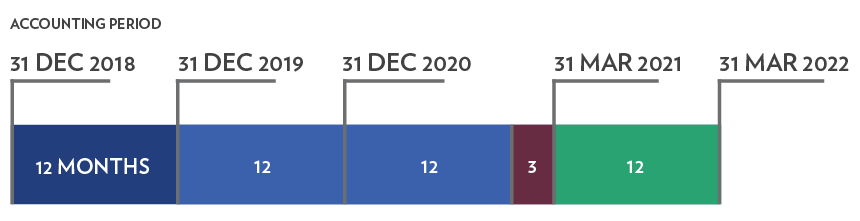

Companies prepare financial accounts periodically; these periods are known as Periods of Account. Periods of account are usually 12 months however they can be shorter or longer than this at a time when a company modifies its year-end date.

Corporation Tax is calculated on the basis of Accounting Periods. An Accounting Period starts when a company starts to trade, or immediately after the previous accounting period ends. An Accounting Period ends usually 12 months after the start, although it can end at the end of a period of account if it is earlier. So if a company has a period of account of say 15 months then it is split into two accounting periods the first of 12 months and the second of three months.

The diagram outlines the assessment basis:

In this example it will be necessary to allocate profits (or losses) between the relevant accounting periods. There are rules for doing this. Trading income, before deducting capital allowances, is apportioned on a time basis. Capital allowances are calculated specifically for each accounting period. Interest paid or received in relation to non-trading loans (bank deposit interest is always non-trading) is accrued to each accounting period (using the appropriate rates of interest so is not necessarily time based). This area can be complex and professional advice should be sought.

Calculation of Corporation Tax

The rates of corporation tax are fixed for Financial Years, which run from 1 April to the following 31 March. A financial year is identified with respect to the year in which it begins, so the year beginning on 1 April 2004 and ending on 31 March 2005 is known as FY 2004.

Four rates of corporation tax are currently set:

- Starting rate

- Small companies rate

- Main rate

- Non-corporate Distribution rate

The starting rate applies to profits of not more than £10,000

The Small companies rate applies to profits of not more than £300,000

The main rate applies to profits above £300,000

The Non-corporate distribution rate is a minimum rate of corporation tax that can apply when a company makes a distribution of dividends to persons (i.e. not companies). See the Non-corporate Distributions (NCD’s) section for more information.

In order to prevent a step change in the applicable rate as a company’s profits grow, transitional arrangements known as taper relief exist:

- Starting rate to Small companies rate

- Small companies rate to main rate

The bands for taper relief are also set for a financial year together with a “fraction” to be applied in the calculation of taper relief.

The band and examples of the calculations are available in the down loadable file above.

When an accounting period straddles two financial years in which the various rates, bands and fractions change; the profits are apportioned on a time basis and the calculations separately done for each financial year.

In making corporation tax calculations appropriate professional advice is strongly recommended.

Self-Assessment Corporation Tax Return

A system of self-assessment exists for companies, similar to that for individuals. The self-assessment form is known as the CT600, and it must be filed together with a copy of the company’s statutory accounts and tax computations no later than 12 months after the end of the period of account. A company must pay its corporation tax no later than nine months after the end of its accounting period. The tax is due whether or not the CT600 has been filed. Revenue and Customs guides and relevant forms can be downloaded from the following web site: www.gov.uk/company-tax-returns

Non Corporate Distributions (NCD’s)

Small companies have recently become subject to a new piece of tax legislation known as Non-corporate Distribution. The legislation appeared in section 28 of the Finance Act 2004 and introduced a new and additional rate of corporation tax known as the Non-corporate Distribution Rate (NCDR).

Its effect is to remove the benefit of the low starting rate of corporation tax if the profits of the company are distributed as dividends to individuals rather than being paid out as salary and subject to PAYE or being reinvested in the business.

NCDR applies where dividend distributions to persons are made after 1 April 2004. It application is by comparing the underlying rate of corporation tax that the company has suffered with the NCDR. If the underlying rate is less then the NCDR then the equivalent value of dividend distributions to individuals is taxed as corporation tax at the NCDR (rather than the lesser underlying rate), the balance of the taxable profits being taxed at the underlying rate. Note NCDR is not a tax on the distribution but an actual corporation tax.

In circumstances where the underlying rate is greater than the NCDR no action is necessary.

There are rules dealing with circumstances where distributions to persons exceed the profit in the year as well as where a group structure exists.

The rate and examples of the calculations are available in the down loadable file above.

It is recommended that professional advice is taken in dealing with this whole area.

VAT – Value Added Tax

What is VAT?

There are currently eight taxes that are levied in the UK by central government. These are divided into two major categories, Direct and Indirect.

- Direct Taxes

- Income Tax

- National Insurance

- Corporation Tax

- Capital Gains Tax

- Inheritance Tax

- Stamp Duty

- Indirect Taxes

- Value Added Tax (VAT)

- Customs Duties (including duties on alcohol, petrol and tobacco

VAT amounts to approximately 20% of the total tax collection.

The basic principle is that VAT is chargeable on the supply of goods and services by a taxable person in the course of any business carried on by them.

A taxable person can be a company, a partnership or a sole trader. If or when the turnover of the taxable person (the value of sales to customers) exceeds a particular level, you may need to register for VAT purposes. The registration level varies from time to time (usually at the time of a budget) so see VAT Rates and Limits above for current levels, or go to the Revenue and Customs site at www.gov.uk/topic/business-tax/vat. More details of registration are given in the section below.

Operating VAT should not be treated trivially and a full discussion with your professional advisor is strongly recommended. The operation of vat is in principle simple:

- On sales to your customers you charge and collect VAT – known as OUTPUT TAX

- You deduct the VAT you have been charged by your suppliers – known as INPUT TAX

- You pay to or receive from HM Revenue and Customs the difference

Unfortunately the actual operation of VAT is more complex. Businesses are obliged to cope with multiple rates of VAT, exempt supplies, rules for trading with European Union as well as other imports and exports. VAT on certain types of business expenses cannot be recovered as input tax. The most common approach is to use the standard VAT scheme; however HM Revenue and Customs allow some special schemes i.e.

- Cash Basis Scheme

- Flat Rate Scheme

- Annual Scheme

For the standard scheme VAT is accounted at the tax point date shown on invoices raised or received.

The Cash Accounting Scheme allows you to account for VAT on the basis of cash amounts actually received or paid out.

The Flat Rate scheme relieves that business of having to record the VAT on every individual sale and purchase transaction, but allows the VAT payable to be calculated as an agreed percentage of the VAT inclusive turnover. The business is still required to provide VAT invoices to all its customers.

Certain conditions must be fulfilled before you can use the Cash Accounting or Flat Rate schemes, please check with your Professional Advisor before making a decision.

VAT returns are required to be sent to HM Revenue and Customs periodically. The most common is quarterly, however in special circumstances monthly returns can be filed or a single annual return (Annual Scheme). Note that the Annual scheme does not mean you only make a VAT payment once a year, an agreed amount is paid quarterly and the final payment must reflect any correction to come to the amount shown on the annual return.

Again proper advice should be sought before moving to one of the schemes.

Registering for VAT

It is important to recognise that it is a taxable person who registers for VAT, not a particular business. This means that a sole trader providing an IT consultancy service who registers for VAT would also need to include any income from say a part time car maintenance business.

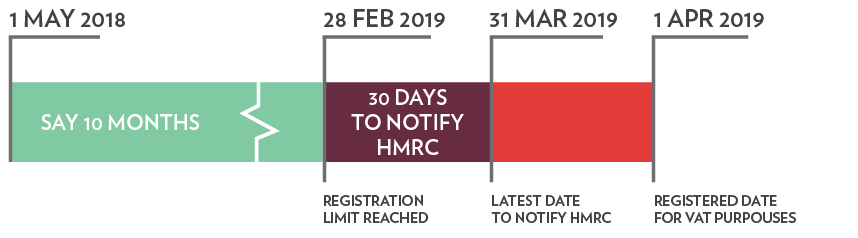

The diagram outlines the registration timetable

A person making taxable supplies becomes liable to register for VAT if, at the end of any calendar month the value of the taxable supplies (excluding VAT) in the 12 months up to that date (or from the date the business commenced if less than 12 months) has exceeded the registration limit (see VAT Rates & limits download above). The taxable person has 30 days from the end of the month the registration limit was reached to notify HM Revenue & Customs. HMRC will register the person with effect from the end of the month following that month (or earlier if agreed).

It is possible to seek a voluntary registration for VAT even if taxable turnover is below the VAT registration limit. It is necessary to demonstrate to HMRC that you are genuinely in business and trading for consideration. It could be an advantage to an expanding or small business for recovering VAT paid on purchases provided that the increased sales value does make the business uncompetitive.

Companies and sole traders must register by completing form VAT1, partnerships must use form VAT2.

These forms may be downloaded from the HMRC site:

www.gov.uk/government/collections/vat-forms

On registration HMRC will issue a VAT registration number which will have to be shown on all VAT invoices issued from the registration date.

VAT Invoices

Whenever a taxable person makes a taxable supply of goods or service to another VAT registered person a VAT Invoice must be given and a copy retained. If the customer is not VAT registered there is no obligation to issue a VAT invoice, but in practice it is likely that a VAT invoiced will be given to anyone who asks for one.

Generally VAT Invoices must show:

- An identifying number

- The taxable persons name, address and VAT registration number

- The date of the supply (known as the tax point)

- The date of issue if different to the date of supply

- The customers trading name and address

- A description identifying the goods or service supplied with :-

- The quantity of goods or extent of the service

- The unit cost

- The VAT exclusive charge

- The total vat exclusive charge

- The rate of VAT

- The rate of any cash discount offered

- The total amount of VAT charged

A less detailed invoice may be issued if the value of the supply is less than £100.

There are rules dealing with rounding issues in calculating VAT and amended rules for invoicing and recording retail transactions.

It is recommended for any VAT questions that professional advice is sought.

VAT Visit/Inspection

Sooner or later (sooner if you are late with payments or error prone) you will receive a visit from the VAT inspector.

Usually you will receive a telephone call to establish an appointment. The appointment is subsequently confirmed by letter.

The letter lays out some of the information likely to be required and will also specify the time period over which the Inspector may wish to review.

It is recommended good practice to keep the necessary information to support each VAT 100 return; It just makes life easier and less stressful in preparing for a visit.

See: www.gov.uk/vat-visits-inspections

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.