Accounts payable

What you owe

Unit 14

These days many business can enjoy credit terms from their suppliers. This period of credit, often known as Terms of Trade, can vary significantly from zero to 180+ days. The value of the amounts remaining unpaid at any time are commonly known as Accounts Payable or Trade Creditors and the period taken on credit as creditor days.

Accounts payable values will be found on a balance sheet in the Current Liabilities section. They are current in that normally the amounts will be paid out in a relatively short time period.

Suppliers will usually only offer credit once the credit worthiness of the business has been investigated.

Usually this investigation may well involve a credit check.

From time to time it would be useful for the business to check it own credit score so as not to be caught out by an unexpectedly poor one.

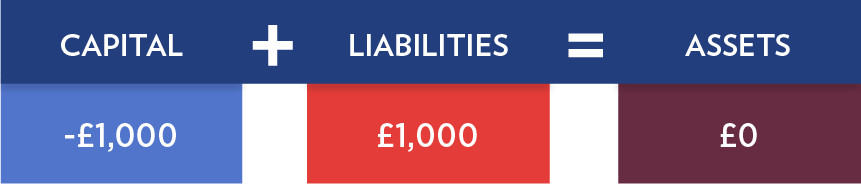

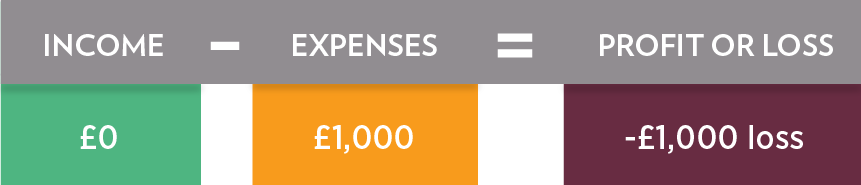

When credit terms are taken from suppliers than in accounting terms we have created a liability for the funds to be paid out in the future. For example the equations for a £1000 bill on credit would be:

When eventually the is bill is paid to the supplier the liability type would move from being an amount payable to a reduced amount in the bank account (a reduction in assets).

Settlement Discounts offered

Suppliers sometimes offer settlement discounts for earlier payment than the agree terms.

This then is a trade off between the value of the discount and the cost of money the business enjoys.

Simplistically the cost of money would be the interest rate associated with any loans or overdrafts or interest rate forgone

on cash amounts the business has.

For example on a bill for £2000 the supplier offers a settlement discount of 2.5%, a benefit of £50.00.

However the business is running an overdraft that costs 8.1% per annum or 0.15% per week.

So the benefit of having say seven weeks credit on £2000 would be not having to pay £3.00 week in interest or £21.00 for the seven weeks.

So in this case paying earlier and taking the discount benefits the business.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.