Cashflow

Understand why cashflow is critical

Unit 9

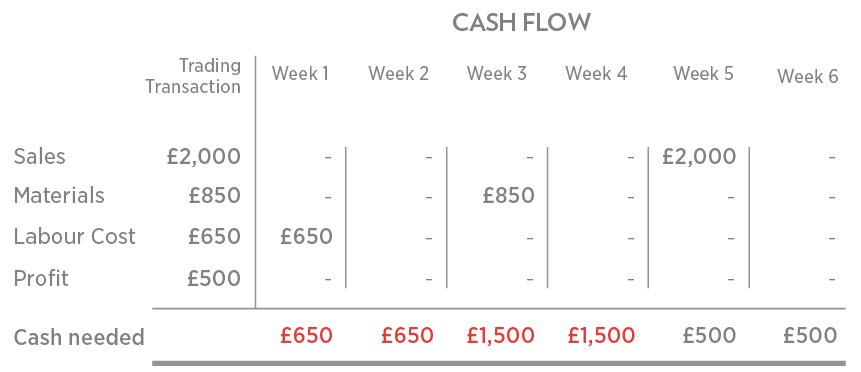

The critical nature of being alert to cash flow is demonstrated in the simple example below, the cash trap:

Whilst the transactions themselves result in an attractive profit, the timing of cash flow items mean that a source of funding of up to £1,500 is necessary until the customer pays.

A number of issues need to be considered.

- Were arrangements in place to cover the cash reservoir gap?, Getting short term funding in a panic can be problematical

- Are the arrangements available for an adequate period?, what happens if the customer is late in paying or queries the invoice?

- Can you agree with the supplier to pay them later, perhaps after you have been paid? Ideally agreed before any difficulties arise.

Managing cash flow is therefore about knowing when cash is coming in, and when it is going out. The regular preparation of cash flow forecasts is obviously good practice and to be recommended. It need not be very sophisticated, a tabular format, showing approximate timings of inflows and outflows. A pro-forma layout for a cash flow forecast is shown in this downloadable Cash Flow Forecast Layout file in PDF format. Be realistic (towards pessimistic) in your estimates, try not to be caught out.

Aside from preparing cash flow forecasts, some additional techniques and practices for managing cash flow may be helpful.

Ensure that your customers are familiar with your terms of trading

Ideally getting positive acknowledgement from whomever makes their payments. Make an effort to police your policy, assertively follow up any customers who do not make payments on time. Investing time in demonstrating that you are serious about getting paid on time will be very positive.

Agree beforehand with Suppliers the terms on which you will be trading

What you agree to, stick to, but try to ensure the terms recognise the reality of your business. If you have to offer extended credit terms to your customers and also if you have to hold stocks for a long time then try to negotiate supplier credit that recognises this.

Get any short term funding agreed beforehand

If your cash flow forecasts indicate some short term funding help will be needed, get it put in place in plenty of time. It is less stressful, demonstrates that you are in control and usually means the facility is cheaper.

Try to match cash needs with facilities

The cash required to buy the longer term requirements of the business such as equipment, ideally needs to come from longer term facilities such as long term loans, capital or retained profits. Funding long term assets from short term facilities can leave the business without sufficient operating funds when they are needed. Likewise if long term facilities are arranged just to cover short term working capital needs then the business can be burdened with unnecessary costs.

Example cash flow forecast layout – Adobe PDF format.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.