Fixed assets

Understand fixed assets and depreciation

Unit 11

Fixed Assets represent those assets and investments owned and used by the business for the long term to further the business. Fixed assets consist of three major categories.

- Tangible assets such as land, buildings, machinery, vehicles, office equipment and computers. The key feature is that they are used in the fulfilment of the enterprise goals and held for the longer term.

- Intangible assets represent notions of value such as goodwill or royalties. For example goodwill represents the excess in value for the business over and above the value of capital employed.

- Long term investments such as shares in another company.

For smaller enterprises it is only tangible fixed assets that will normally be relevant.

Tangible assets have been purchased to be used in the business with a view to generating income.

It is clear that most tangible assets do not last for ever (except perhaps land) and therefore must fall in value over time,

the recognition of this fall in value is known as depreciation and because of the double entry system it has two impacts.

The first is to deduct an expense from income and the second is to reduce the value of the tangible asset.

In balance sheet terms, fixed assets are reduced in value by depreciation and at the same time the Capital is reduced

because the retained profits are lessened by the same amount.

The trick is to determine how depreciation is calculated. The main factors that cause fixed assets to devalue are:

- General wear and tear through usage e.g. Vehicles, computers, plant

- Passage of time, such as the lease on an office

- Depletion, such as oil from an oil field

- Obsolescence, a newer machine becomes available with significantly improved technology that makes the existing machine uncompetitive.

These factors can give some guidance as to an appropriate time period for calculating depreciation,

for example an estimate of the time for a vehicle or computer to be replaced is relatively well known.

Experience of other pieces of equipment will start to provide a guidance as to its life span.

Clearly for something like a lease, the time period is known and the rate of depletion of an asset can be assessed.

Rates of obsolescence are more difficult and judgement will be necessary.

In essence a time period for each asset (or more normally groups of similar assets) needs to be determined from the above.

Having got the time period, for example five years, a decision is needed as to whether at the end of the time period

the asset is totally valueless or if some residual resale value will exist.

If a vehicle is assumed to have a four year depreciation life it may still be worth 10% of its original value.

We now have a time period and the total decline in value that must be depreciated (original value less residual value) a rule is now needed to determine how much depreciation is treated as an expense during each business trading period. Many rules exist but the two most common are

- straight-line method – which gives the same amount of depreciation for each trading period

- reducing balance method – which weights the amount of depreciation to the earlier time periods

The straight-line method is very simple, take the amount to be devalued and divide by the time period and apply that amount to each trading period.

For example a Van costs £15,000, it is assessed to have a useful life of 4 years after which it will be worth £3,000.

The straight line depreciation will be (15,000-3,000)/4 = £3,000 per year.

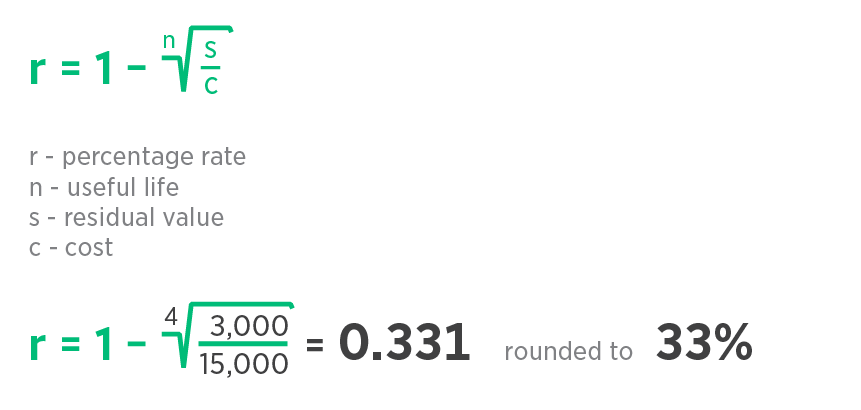

Reducing balance takes the cost amount and uses a percentage for each trading period. The percentage is selected to reduce the value of the asset to the residual value at the end of its useful life. So for example if the van above has a life of four years, apply a percentage of 33%. So in year one the depreciation is 15,000*0.33 = £4,950, but in the second year it is (15,000-4,950)*0.33 = £3,317 and so on. In order to determine the percentage that will calculate depreciation down to the residual value the following formula can be used.

Some useful terms

- Cost value (sometimes Gross Value) is used to describe the original purchase value of the asset

- Cumulative Depreciation represents the sum of all the depreciation that has been applied to an asset to date.

- Net Book value, is the Cost value less cumulative depreciation, it is the value in the balance sheet.

Sometimes assets such as Land and Building actually increase in market value and this needs to be recorded, this is done by revaluing the Cost Value of the asset to the new value.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.