Primary accounting reports

How cashflow, P&L and the balance sheet are related

Unit 6

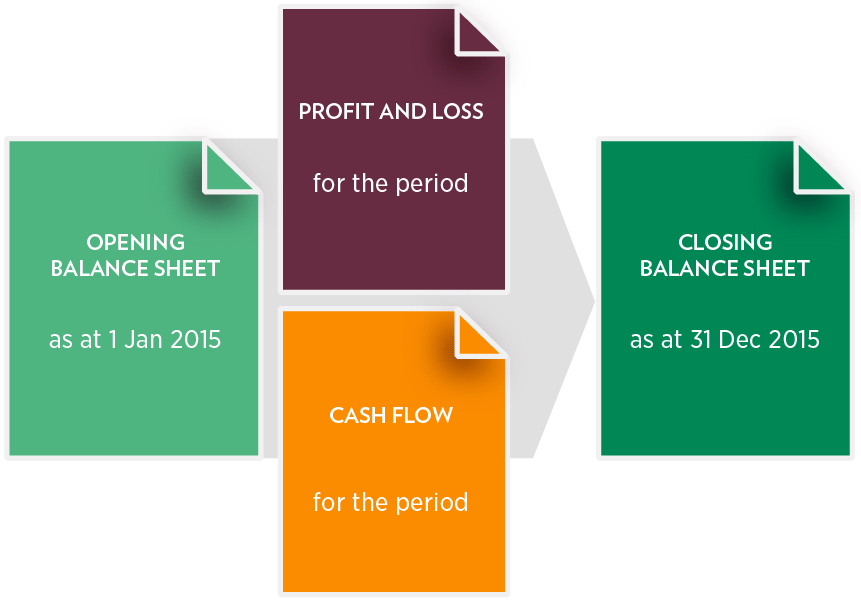

A set of accounts consists of an opening balance sheet, a profit & loss and cash flow statement for a period and finally a closing balance sheet.

The balance sheet gives a snapshot of the business at a point in time. A snapshot may be taken at any convenient point and the changes that have taken place between points in time are of great interest in financially managing a business.

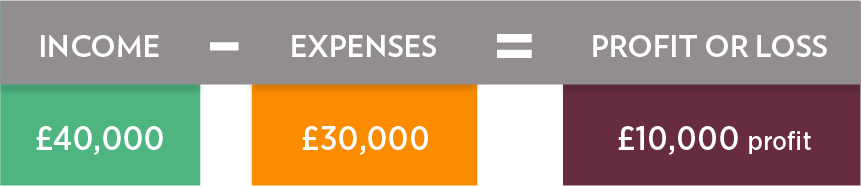

The profit and loss statement quantifies and analyses the income and expenses (and therefore a profit or loss)

of the business, for the period between the two balance sheets.

Directly as a result of double entry, a change in any value in the profit and loss statement will have an impact on the closing balance sheet.

In a similar manner the cash flow statement provides an understanding of how cash flows in and out of the business

and is closely linked to the both the profit and loss and balance sheets.

Cash in this case is usually accepted to be both bank accounts with positive balances as well as any physical cash held.

More on this in a later module.

An example may help:

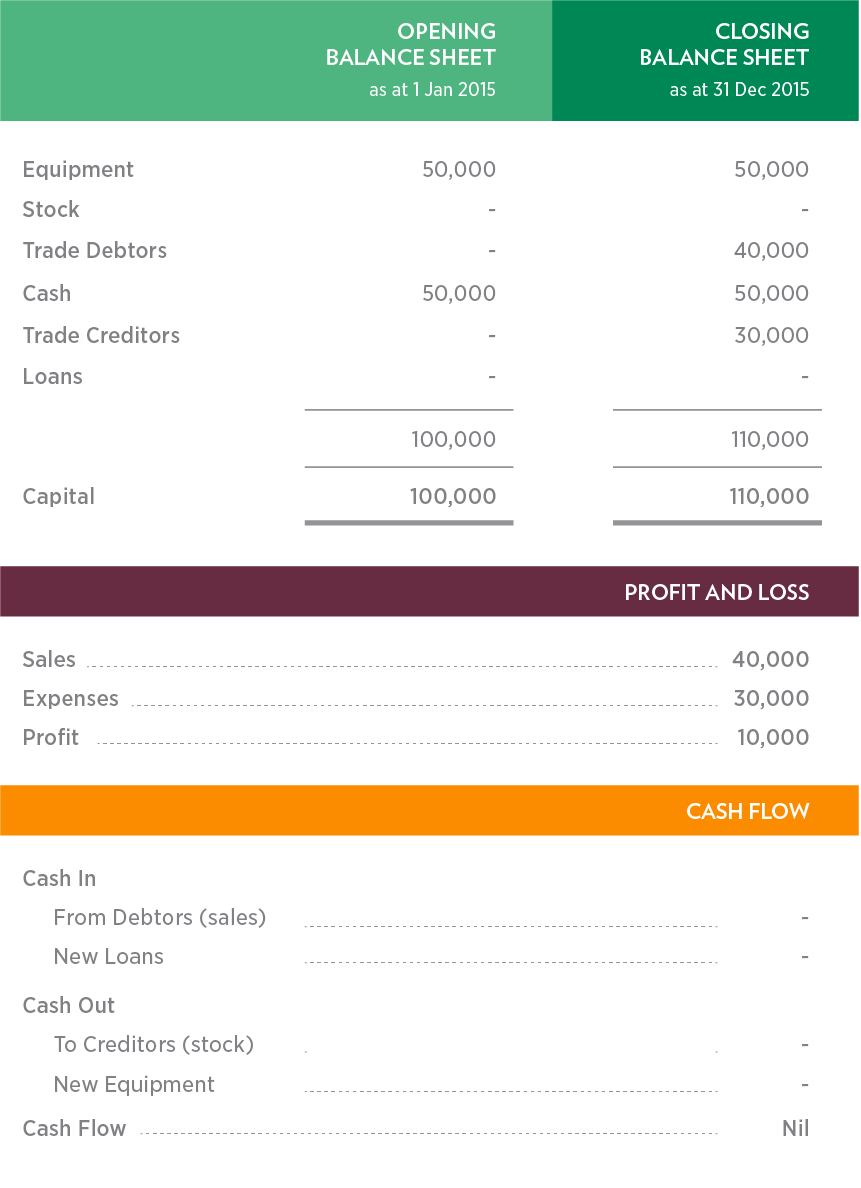

Owners have invested £100,000 in a business to produce computers.

Equipment was bought for cash costing £50,000 and they then purchased, on credit, materials costing £30,000.

Using the materials, computers have been produced and sold for £40,000 on credit terms.

These equations are translated into an opening and closing balance sheets and profit and loss as shown below (all in pounds sterling):

The profit & loss for the period has resulted in a change to the capital account and debtors and creditors. There has been no cash flow; the cash account has not changed.

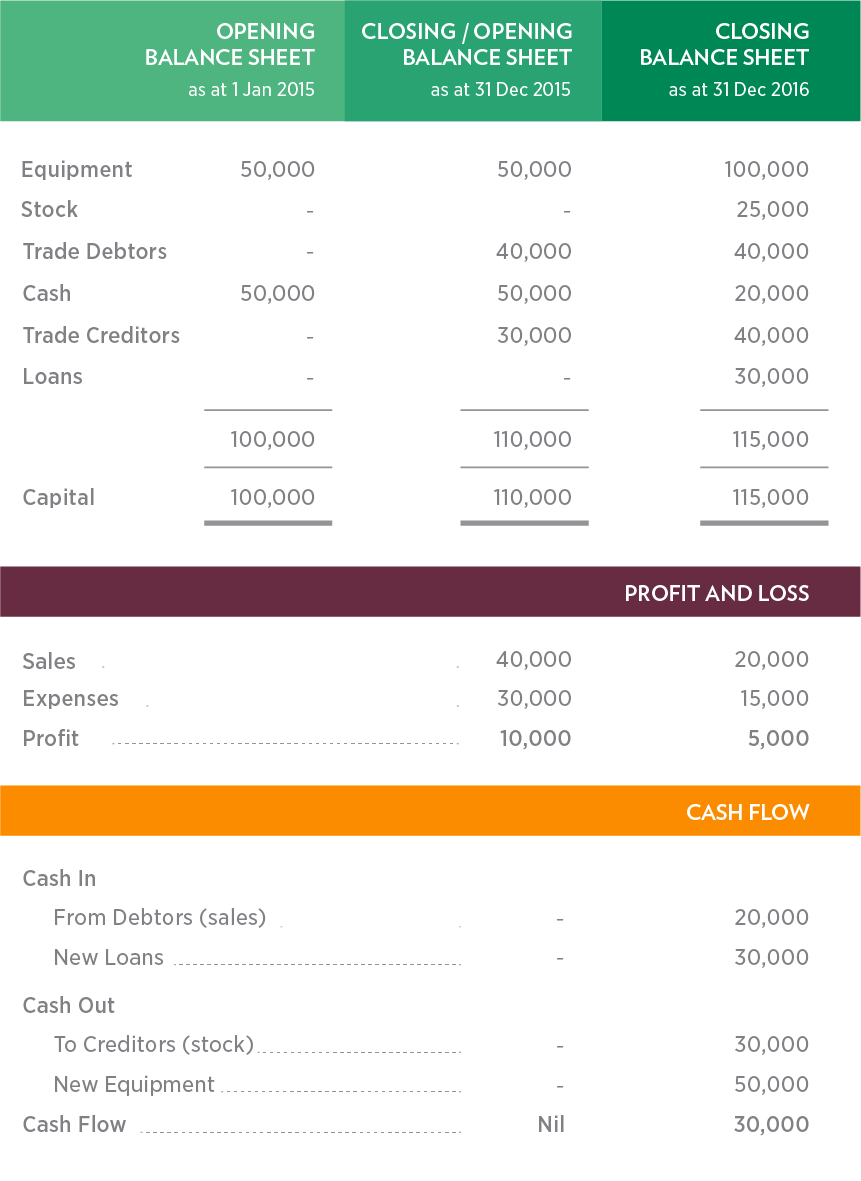

In the next period however, of the £40,000 worth of sales, half has been received in cash. A further £20,000 worth of credit sales have been made using £15,000 worth of materials from further materials stock purchases on credit of £40,000. More equipment has been bought for £50,000 and the original materials of £30,000 have now been paid. A bank loan of £30,000 has been arranged and the cash received. In this case the next balance sheet, profit & loss and cash flow would look like:

Many changes have impacted the balance sheet, the profit & loss added a further £5,000 to the capital. The purchase of additional equipment, payments to suppliers (creditors) and receipts from customers (debtors) have changed accounts. Many of these changes can be seen in the cash flow which shows an outflow of £30,000 in the period. It is interesting to note that if a loan of £30,000 had not been arranged the business could have run out of cash.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.