The accounting equation

The foundation for double entry bookkeeping

Unit 3

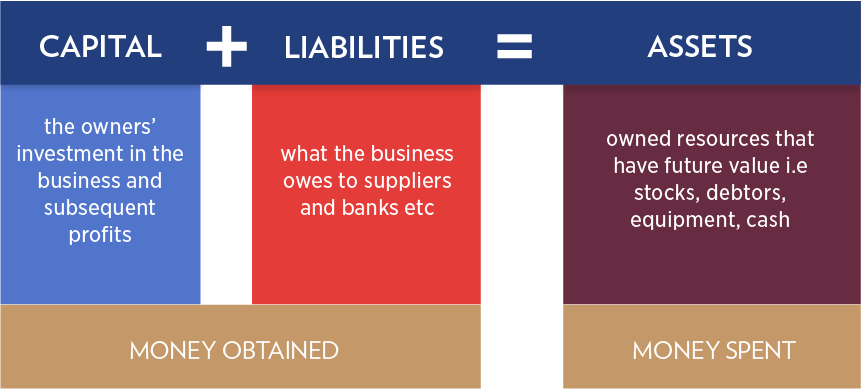

A basic concept in accounting is that every business transaction will impact two elements of a simple equation which is known as the accounting equation.

The accounting equation is shown in the diagram below:

This is known as the double entry system, but more on that in a later unit.

For now consider this situation:

Owners (Shareholders) decide to invest £2000 in a new enterprise. The accounting equation would look like this:

The same business then buys machinery (for £1000) and materials (For £200):

Finally if the business buys some more material for £500, but for the moment does not pay for it, i.e. it owes the supplier, the equation would look like this:

This basic equation is turned in to a document that:

- At a specific date (point in time)

- Identifies the detail items in the equation

This is called a BALANCE SHEET

You may like to try to work through some additional equations; these together with the answers can be down loaded from the link

Further Accounting Equation Examples – Adobe PDF format.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.